AIDED

ARTS

Jr. College

English

French

Gujarati

Hindi

History

Marathi

Philosophy

Political Science

Psychology

Sindhi

Sr. College

COMMERCE

SCIENCE

Jr. College

Sr. College

UNAIDED

B.Voc

Commerce

Senior College - Accountancy

History of DepartmentHistory The Accountancy Department was set up 26th July 1980 and is engaged in Accountancy Subjects of B.Com., M.Com. and B.A. Courses. The main objective is to make the students knowledgeable and skilled to improve their employability and make them professionally competent locally, as well as, globally. Staff Awards/ Recognition Ms. Jaisinghani Reshma is a Certified Entrepreneur Educator by National Entrepreneurship Network in association with Wadhwani foundation, NSTEDB and Department of Science and Technology.

Highlights Some of the faculty members are Professional practicing Chartered Accountants. Hence, the blend of their academic excellence and professional expertise help shape the careers of the students at domestic, as well as, international level. Contact Ms Reshma Jaisinghani: reshma.jaisinghani@jaihindcollege.edu.in

|

Faculty

CA Jimy Wankadia Former Vice Principal of Commerce (2019 -2022)

Ms. Reshma Jaisinghani Designation: Asst. Prof.(Vice Principal, Commerce), HOD of Accountancy Dept.

Fatema Fanuswala Designation: Asst. Prof.

Prachi Mane Designation: Asst. Prof.

Pratishtha Sharma Designation: Assistant Professor

|

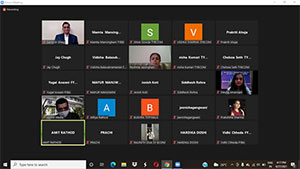

Activities1) Activities conducted by accountancy association 2021-22Webinars on:

2) Activities conducted by accountancy department

3) PHOTO GALLERY

An Insightful session on the Union Budget and Tax Planning held by Mr. Shardul Shah.

An Insightful session on the Union Budget and Tax Planning held by Mr. Shardul Shah.

Webinar on Forensic Accounting on 29.08.2022

Webinar on Forensic Accounting on 29.08.2022

Alumni meet cum panel discussion on 24.09.2022

Alumni meet cum panel discussion on 24.09.2022

|

Syllabus |